The cost of customer acquisition is skyrocketing. Why? Companies have more channels to create content from videos, blogs, email, paid and organic search to influencers, social media and more. Increased competition, higher opt-out rates, and the limited availability of lucrative channels like trade shows have also contributed to the rising costs.

To put things in perspective, the Wall Street Journal reported that loose-leaf tea seller Plum Deluxe used to gain a new customer for every $27 spent on Facebook and Instagram ads. That cost is now ten times higher, which has led the company to cut its spending. Many organizations face the same challenge. According to ProfitWell, customer acquisition costs are nearly 70% higher for B2B companies and more than 60% higher for B2C companies than they were just six years ago.

Customer acquisition costs are nearly 70% higher for B2B companies and more than 60% higher for B2C companies than they were just six years ago.

(ProfitWell)

Churn matters

Every company loses customers which means it has churn. It’s a cost of doing business. But the way you view churn and how, and if you proactively address it can make all the difference. This guide is designed to help you fully realize the impact churn has on your growth strategy, as well as provide practical tips on how to reduce churn.

Churn is important because it affects your company’s profitability. Most B2C organizations lose 60%+ of their new customers annually. If you’re losing 60%+ of the customers that come in the door, you’re continually throwing 60%+ of your budget dollars away.

Existing customers buy 90% more frequently, spend 60% more per transaction, and bring in 23% more total revenue and profitability than newer customers. Data is at the heart of measuring, understanding and minimizing churn. The more you learn about your customers and their behavior, the better you can forecast and influence future expected revenue.

“Churn happens throughout the customer journey but there are two places where churn happens that you can’t afford to ignore. The first is one we all know—it’s with our best customers. Most organizations work hard to keep their best customers. The other isn’t as well recognized. It’s at the first and second transaction. This is where companies are losing 60% or more of their customers. The real kicker here is that most companies don’t recognize churn as a retention problem, they see it as an acquisition issue.”

– Erin Raese, SVP of Growth & Strategy, Annex Cloud

Acquisition or retention—a shift in perspective

We’ve heard over and over again from CMOs across all industries, “I don’t have a retention problem, I have an acquisition problem”. Many of these CMOs have strong loyalty strategies, however, they see loyalty and retention as something that happens later in the customer journey or lifetime with the brand—after the sixth or tenth purchase, or perhaps even after a year or two of being a customer. Their loyalty strategy is relegated to the back end of the lifecycle, with the sole purpose of putting a fence around their best customers. While this is super important, they’re missing the opportunity that a strong loyalty strategy can bring to the early stages of the customer lifecycle.

If you define early-stage churn as an acquisition problem, ask yourself a few simple questions.

-

Why wait to get to know your customer?

-

Why wait to make a positive, impactful impression?

-

When you meet someone for the first time, do you just say hello and walk away? Or do you stand there, ask them a few questions, and get to know the person?

-

Why would you want your customers’ experiences to be any different?

Engaging customers at their first touchpoints with your brand, in and around their first purchase, will make a positive impression on a customer, beginning the two-way value exchange necessary to build a long, profitable relationship. Adding value by putting a retention or loyalty focus on early churn, instead of looking at it as an acquisition problem, prevents a lifelong customer expectation of discounts to continually win their business. Yet so many organizations don’t recognize or fail to seize this opportunity.

“The most successful brands look at loyalty and address churn starting day one and see them as an integral part of their growth strategy.”

– Erin Raese, SVP of Growth & Revenue, Annex Cloud

A first-time customer has a 27% chance of returning. If you can get the customer to come back and make a second or third purchase, the chance of making another purchase jumps to 54%.

Understanding customer churn

Customer churn, also known as customer attrition, is the number of customers that have discontinued purchasing from your brand in a given period of time. Companies typically look at churn by month, quarter, or year. Annual is most common unless your products are paid for monthly—such as mobile service, gym memberships or SaaS subscriptions—in which case these brands measure churn monthly. Unless it’s kept in check, churn can creep into your business, silently stripping away your growth and wreaking havoc on your bottom line. Accenture estimates companies lose $1.6 trillion per year due to customer churn.

Why customers leave

We’ll take a deeper dive into factors that contribute to churn a little later in this guide. But according to the Database Marketing Institute, the reasons customers leave fall into four main categories:

-

They move, die or no longer buy in your category

-

They’re unhappy with the price

-

They’re unhappy with the product

-

They’re unhappy with the way they’re treated

Realistically, you’ll have to accept that a certain percentage of your customers will pass away. There’s also a portion that will move up or down within your market because they’ve either outgrown you or have scaled back, so you’re no longer the best fit. Overcoming dissatisfaction with price is a discussion for another white paper, however, it’s important to be aware loyal customers are less price sensitive. Product dissatisfaction may be due to a wide range of reasons—targeting the wrong market, lack of differentiation or innovation, inflating expectations, trying to solve the wrong problem and many others.

While you have limited control over these first three categories, you have complete control over the fourth—how you treat customers. Consumers today don’t just want you to solve their problems. They want to feel seen, heard, and special. Just as in personal relationships, it can be difficult to pinpoint where things went south with your customers but the tips in this guide can help you start your customer relationships on the right foot and keep them on the right track with a strong focus on creating emotional bonds that build lasting customer relationships.

Increasing customer retention rates by 5% can increase profits up to 75%.

(Bain & Company)

Churn and retention—two sides of the same coin

Churn is an inevitable part of any business. Ignoring churn or delaying a strategy to address customer churn can have critical and lasting repercussions on business growth, since it’s inversely proportional to your customer retention rate. The higher your customer retention rate, the lower the attrition rate.

Whether you measure churn (glass half empty) or retention (glass half full), you’re basically looking at the same thing—and measuring churn is becoming more common. Simply put, the more customers you keep, the better it is for your bottom line. According to Forrester, it costs five times more to acquire new customers than to keep an existing one. Retained customers also bring in more revenue—a Bain & Co. report states that a 5% increase in retention can drive up to a 75% increase in profits.

Retaining customers isn’t just financially viable, it also has a strong impact on overall brand value, since retained customers have a high probability of turning into loyal customers. Lost customers impede financial growth and have a massive impact on overall sales and revenue. This is why customer attrition rate is a critical business health metric. Churn reflects the weakness of the business while a high retention rate indicates strength and success.

Without a loyalty initiative, only 20% of first-time customers will make a second purchase.

(Zodiac)

The value of repeat customers

Repeat purchasers help your business in more ways than bringing in revenue.

They spend more

Gartner reports 80% of profits come from 20% of your existing loyal customers. Satisfied customers come back to your brand and repeat customers typically spend more when they return. Trust established with the first purchase makes it convenient for customers to count on a brand they’ve tried and tested.

They’re easier to sell to and cost less

Repeat purchasers already trust and like your brand. They’re confident you meet their quality standards and other important purchase criteria, so they’re more likely to buy from you, saving you marketing costs, time and effort.

They have a higher customer lifetime value (CLV)

CLV is the overall profit generated by a customer during their cumulative journey with your brand. Repeat customers have a higher CLV when compared to one-time customers.

Loyalty programs are proven to increase customer lifetime value by up to 30% or more by increasing visit frequency, increasing spend per visit and winning back lost customers (Forbes).

They promote your business

People enjoy sharing things they love with others. Repeat customers that develop an affinity towards your brand can become strong brand advocates who promote you to others—and refer others to you.

They’re more likely to turn into loyal customers

Continued positive experience with your brand helps build trust among customers and eventually fosters loyalty. Loyalty program engagement builds emotional bonds that turn repeat purchasers into loyal customers. Customers with an emotional connection with a brand have a 4X higher CLV than the average customer.

Calculating churn

Before you begin strategizing on how to reduce customer churn, it’s important to identify your churn rate. There are three basic ways to calculate your customer churn rate—the simple method, the adjusted method and the predictive method.

1. The Simple Method

This method uses a simple calculation to determine churn. Dividing the total number of churned customers in a given time period by the number of customers you had on the first day of the time period.

The simple method gives you an estimation of the churn rate but does not factor in that as a brand grows it acquires more customers. This is best used as a quick estimation of churn rate at a given point in time.

2. The Adjusted Method

This method gives a more realistic estimation of churned customers. Simply divide the total number of churned customers by the average number of customers in that particular time period. The drawback in this calculation is that it fails to scale to various time frames—be it daily, weekly, or monthly.

3. The Predictive Method

A widely used method of calculating churn, the predictive method, uses two month’s of customer data to calculate the customer attrition rate for one month. For example, divide the number of churned customers in two months (January + February), then divide by the number of customers you had in the month of January. The main drawback of this method is that the attrition rate is one month old.

Analyzing churn

How do you know if your churn rate is good, bad, or reasonable (bet you thought we were going to say ugly). Rather than comparing your rate to others in your industry, it’s more valuable to evaluate it in terms of what your churn was last year, how you can improve it, and the impact on your business.

“Churn is ultimately an indicator of how well you’re managing your customer relationships, and every brand has room for improvement in this area.”

– Erin Raese, SVP of Growth & Strategy, Annex Cloud

For example, let’s say you have a 5% monthly churn rate. The net result is you’re losing roughly half of your customers each year, about 46% annually. This means if you started January with 100 customers, you’d have only 54 customers left at the end of December. Ultimately what this really means is that over the course of the year you’d need to acquire 46 customers just to break even. And if your goal is growth, you’d actually have to work four times as hard; twice as hard just to replace those customers and then more to add to your overall customer count. In short, you’d be running really hard but not accomplishing your goals.

Harvard Business Review recommends looking at churn as an indicator of behavior rather than a metric. They suggest managers ask these key questions to get to what’s behind the number and help identify what can be done to change it.

-

What are we as a company doing to cause customer turnover?

-

What are our customers doing that’s contributing to their leaving?

-

How can we better manage our customer relationships to make sure it doesn’t happen?

Predicting churn

Although there’s no sure way to predict customer churn, with the help of analytics and a predictive model you can estimate which customers are more likely to churn. An effective churn predictive model will study customer history and purchase patterns to predict future actions.

Data derived through loyalty programs can be a great indicator of customer churn. For example, if the customer is actively earning and redeeming points, she/he is most likely to stick with your brand to reap the rewards of your loyalty program. Customers that haven’t redeemed their points in a long time are more likely to churn. An investigative look into the customer’s journey with your brand will give great insights on customer behavior. For instance, a noticeable decrease in purchase frequency or the average time spent on the website and app are indicative of churn. Early detection of such traits can help in identifying at-risk customers, giving you time to formulate new strategies to win back their attention, trust and confidence.

Stages of churn

Customers may drop off at various times throughout their lifecycle. Churn is typically categorized into three stages, each with its own characteristics and strategy.

Early-stage churn

Early-stage churn is when you lose customers after the first or second purchase. Many companies don’t realize how significant the dip is at this point. The reality is 60 – 70% of their customers simply aren’t coming back. Improving churn in the early stage can have a huge impact on your churn rates throughout the rest of the customer lifecycle. Keeping customers engaged and adding value from day one is one of the best ways to minimize early-stage churn.

Mid-stage churn

Mid-stage churn is when you lose customers after they’ve been fairly regular customers for several years. This is where most companies focus their retention efforts. At this stage, it’s already established the customer is satisfied with your products. Clear and consistent communication, responsive service, timely and relevant offers, as well as education and engagement strategies can help to retain customers and considerably reduce mid-stage churn.

Late-stage churn

Late-stage churn primarily refers to the loss of your best customers. We’re talking about the top 20% of your customers that account for 80% of your revenue. Causes of late-stage churn could vary from brand fatigue, competitor tactics or customer experience but the underlying factor here is a lack of loyalty. “Late-stage churn often results in the loss of your best customers and, while the percentage may be lower, the cost to your business is significantly greater”, explains Erin Raese, Annex Cloud’s VP of Growth & Strategy. “By this stage, if loyalty isn’t established, you need to step up your game and adopt a loyalty strategy that rewards customers for profitable behaviors.”

69% of customers leave because they believe you don’t care about them.

(RightNow’s Customer Experience Impact Study)

How companies use churn rate

Keeping a pulse on how many customers leave and understanding why helps inform marketing and other strategies. A low churn rate indicates things are working well, a high churn rate could signal the need for improvement. That may be your marketing strategy, customer service methodology or something else. In short, churn rate is a valuable metric that speaks to how well you are or aren’t engaging with and serving your customers.

Marketing managers can also look at churn rate for specific customer segments. Today, with the right data and technology, they can do more than understand what happened in previous periods, they can actually predict what’s going to happen. While marketers typically have the biggest interest in churn rate, investors may also use it to evaluate the health of a company.

Factors that contribute to churn

Poor or inadequate engagement

Customers want more than transactional relationships with brands, making customer engagement more important than ever. Engagement is the cornerstone of a strong brand and customer relationship. Consistent, meaningful engagement increases brand recall value and helps build emotional bonds that go beyond purchases. Lack of quality engagement can create a disconnect, encouraging customers to seek out more customer-centric brands.

Lack of perceived value

The price is what a customer pays. Value is what they get. Competition is tougher than ever, and customers expect value they can’t find anywhere else. According to sales expert and emotional intelligence coach Liz Wendling, customers don’t necessarily choose the cheapest option. Customer preferences have nothing to do with price and everything to do with the value you are conveying. When your potential customers tell you it’s about the money, it’s actually code for ‘show me the value’.

Incomplete view of the customer

Today it’s easier than ever to opt out to avoid receiving offers that have no relevance to your preferences, values or lifestyle. And we all know how frustrating it is to have to repeat ourselves when communicating across different staff members or platforms to remind a brand of who we are and how long we’ve been doing business with them. Consumers have overwhelming options at their fingertips and will quickly switch when it’s clear you don’t know them.

Inconsistency

Consistency breeds trust. Consumers want to rely on a seamless, relevant experience no matter where or how they engage with your brand. If their online or mobile experience is miles apart from their in-store experience, it undermines that trust and confidence.

Dissatisfying customer experience

According to PricewaterhouseCoopers (PwC), 73% of customers agree that customer experience helps drive their buying decision, which is why more and more businesses are investing in CX. In fact, Forbes reports two-thirds of companies compete based on customer experience.

Steps to reducing customer churn

Identify your best customers

Churn is an unavoidable part of every business. Not all first-time customers are your target audience, but you should make it a priority to keep every customer engaged from their first interaction, and especially after their first transaction. You need to identify and focus your attention on your best customers. Once you’ve identified your target audience, it’s easier to market to them and formulate strategies specifically designed to attract and engage these customers.

Analyze the root cause

According to SVP of Growth & Strategy, Erin Raese, Annex Cloud has observed churn rates from 60 to 80% in retail and travel, even higher in direct sales. If you’re facing an increased attrition rate, you need to detect it at an early stage and investigate the possible causes. It could be due to insufficient customer support and service or product quality, all of which can be easily remedied. However, if a lack of loyalty is causing the churn, you need a data-led strategy to understand which behaviors lead to loyalty.

Improve relevance

Data is at the heart of identifying when and why your customers churn. Having a unified customer profile that all customer-facing teams can use is essential to serving up relevant, timely communications and offers. Knowing your customers at a deeper level requires collecting data directly from customers across their journey.

Monitor feedback across platforms

Today’s average consumer is quite vocal about their preferences. Regularly monitoring reviews and feedback across various platforms and third-party review sites can give you great insights into your customers’ preferences and mindset. Collecting this data as well as your personally generated reviews and feedback data will help you recognize recurring issues and customer concerns that eventually lead to customer churn. Remember engaged customers provide more feedback and, the more feedback, the better.

Customers are becoming more demanding of the people and organizations with whom they do business. But when they trust them and are fully engaged, they:

Create stickiness with engagement and unique value

Engaged customers spend more and tend to stick around. Keeping customers engaged between purchases, across their entire journey, gives you on-going opportunities to add unique value you know matters to them and they can’t find anywhere else.

Focus on customer experience

According to Forbes, customers switching brands due to a poor customer experience costs U.S. companies $1.6 trillion. A Gartner survey shows customer experience will overtake price and product as the key brand differentiator. Today’s consumers want the same personalized experience whether they’re interacting with your brand in-store, online, or on their mobile device. Make sure you’re able to recognize and reward customers across every touchpoint.

Nurture and foster loyalty

The best way to ensure customers stay connected and interact with your brand for a prolonged period of time is by nurturing and fostering loyalty. By creating a mutual value exchange, loyalty provides the opportunity to have an on-going conversation with your customers, keep them engaged across their entire journey, reward them for that engagement and specific behaviors and build lasting emotional bonds.

Educate your customers

Loyalty is a two-way street. Customers are sharing their personal details in exchange for you using their data to improve their experience. On the flip side, the more your customers know about your brand and your products and services, the more connected they become and the more confident they’ll feel about purchasing from you. Education is a way to stand out from competitors, and also gives you the opportunity to reward customers for taking advantage of things such as how-to videos, mini workshops, quizzes and more.

Build a community

We all want to be a part of something greater. Strive to build a community of your loyal customers. Reward customers for joining, maybe even make your VIP community exclusive to higher loyalty member tiers.

How loyalty helps reduce churn

A loyalty strategy is one of the most effective ways to drive repeat purchases, move beyond transactional relationships, and build lasting bonds that reduce churn. Here are some of the key ways loyalty helps you reduce churn.

Leverage first-party data

First-party data can be a great source to analyze customer behavior and purchase patterns. Data and analytics can help you identify customers most likely to churn along with their in-depth purchase preferences. Annex Cloud’s Loyalty Experience Platform™ collects zero- and first-party data at scale.

Access a unified customer profile

Equipping all customer-facing teams with a robust, consistent, accurate customer profile enables them to deliver a seamless, personalized experience across every touchpoint. Loyalty provides the data and insights you need to know more about, connect more with, and sell more to your customers over their entire journey.

Create data-led engagement

Loyalty creates a mutual value exchange where customers willingly share their personal data in exchange for you delivering a unique, meaningful experience. This value exchange is on-going, meaning you create timely, relevant engagement based on their data, they share more data, which enables you to deliver even more value-based interactions across their entire journey. Loyalty technology, integrated into your robust tech stack is the most effective way to manage the value exchange and enable data-led engagement at scale.

Reward profitable actions and behaviors

Who doesn’t like to be rewarded? Loyalty provides the opportunity to incentivize customers for taking specific actions and engaging in certain behaviors. There are plenty of ways to reward customers aside from discounts—including gift cards, travel, charitable donations on their behalf, merchandise—even exclusivity, such as early access to new products.

Offer feedback mechanisms

Gathering customer feedback is essential to reducing churn. Loyalty provides various ways to gain customer feedback—including Ratings & Reviews, contests and surveys. And, of course, you can reward customers for these actions, which sweetens the pot.

Provide a community

Loyalty membership is the foundation for an ongoing value exchange—a give-and-take for both brands and members at multiple touchpoints across the customer journey. Each engagement increases the value of the member to the brand, and the value of the brand to the member. The brand receives value through ongoing engagement, transactions, and valuable customer data that creates a richer ‘golden record’. The member receives value through truly personalized experiences, recognition, special benefits and rewards.

Here’s an overview of what a value-based relationship might look like between a brand and its loyalty members.

The value of membership and the ultimate loyalty of a customer starts with the first interaction. The value exchange moves the customer along their journey through membership to advocacy—adding more and more value over time.

Importance of personalization actions for first-time purchasers

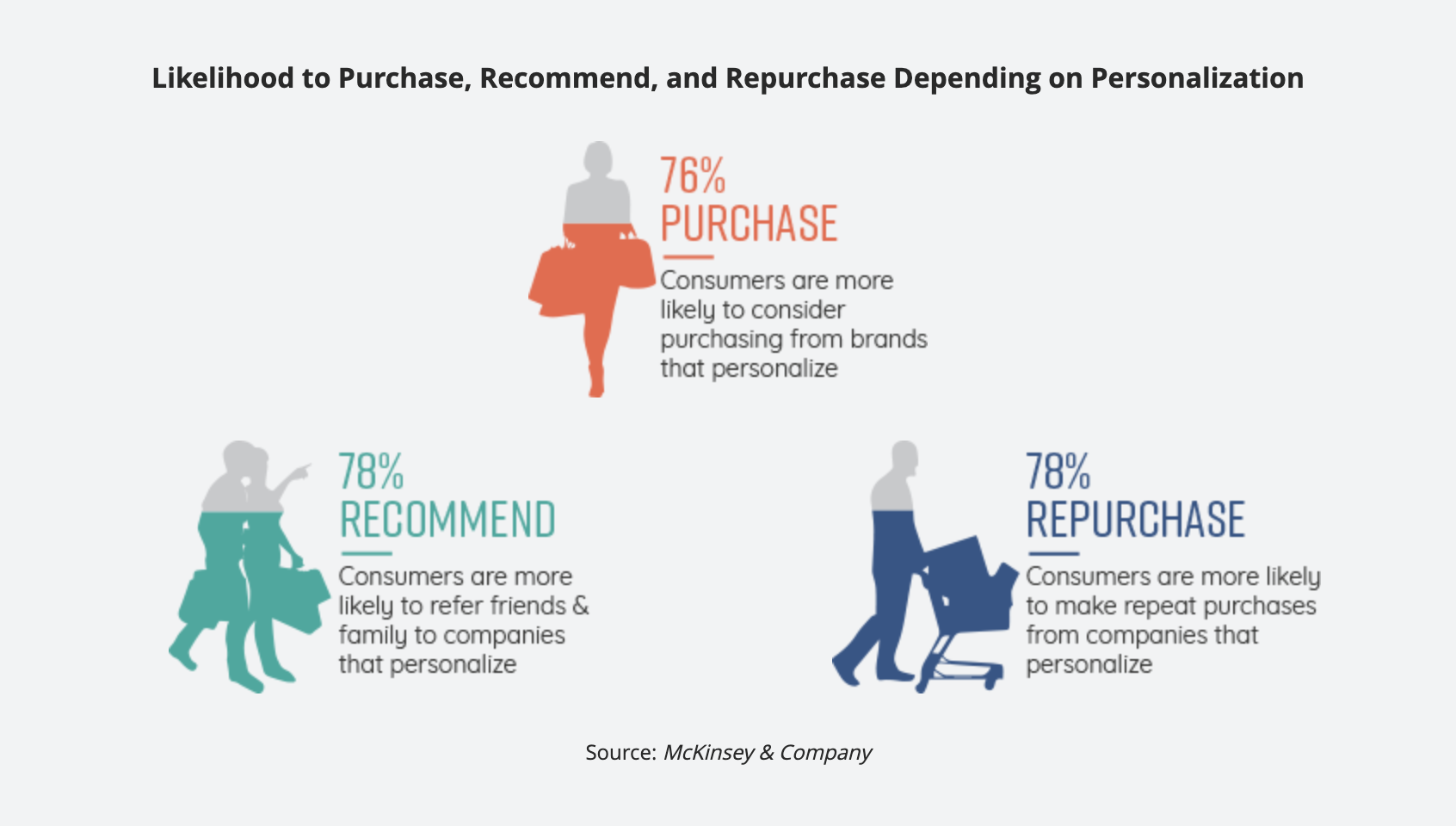

Before the digital age, store managers developed and maintained customer relationships. Today’s consumers still expect that same connection and experience, no matter where they engage or shop. McKenzie & Company research shows how your customers look at, and what they expect, when it comes to personalization.

Personalization goes way beyond including a customer’s name in communications or marketing efforts. Research shows 72% of shoppers expect the businesses they buy from to recognize them as individuals and know their interests, likes and dislikes, motivations and more. This type of hyper-personalization takes a lot of good data.

Personalization directly influences buying behavior across the customer lifecycle

Loyalty enables the level of personalization your customers expect by pushing robust first-party loyalty data across your tech stack, enabling you to deliver unique, personal experiences and promotions at the customer level at scale. This puts the focus on building a relationship rather than just getting the next transaction. McKinsey reports even small shifts in improving customer intimacy create a competitive advantage and these benefits grow over time. On-going engagement creates more data, enabling even more relevant experiences that build lasting emotional bonds and boosts customer lifetime value.

Loyalty in action

Annex Cloud’s Loyalty Experience Platform enables brands to personalize every touchpoint across the customer journey, create data-led engagement that builds lasting emotional bonds and reward customers for specific actions and behaviors—reducing churn by delivering value customers can’t find anywhere else.

Here’s an example of how the various touchpoints and value exchanges in a loyalty program might look:

An Annex Cloud client in the telecommunications industry reduced churn by 12% in the first ten months. We’ve seen similar, even greater, results across many industries.

Here are a few examples of how Annex Cloud clients have integrated loyalty as a key part of their strategic growth plans.

Philip Morris International

Loyalty objectives

-

Move new customers from starters to adopters more effectively

-

Establish an emotional connection between the user and the product

-

Create a tiered loyalty program with unique benefits for members of each tier

-

Program features

-

Custom rewards program that precisely fits their objectives

-

Identify boutique customers, actions they’ve taken, and level to enable a

personalized conversation

-

Ability to guide people to a specific channel to get them to experience the brand

NuSkin

Loyalty objectives

-

Reduce their high churn rate

-

Engage customers from their first interaction/purchase

-

Gain new customers by rewarding existing customers for referrals

Program features

-

Engage referred customers from day one

-

Reward new customers for trying new products

-

Tiered program that includes a range of rewards, including points, charitable gifts, coupons/vouchers, and more

Loyalty next steps

Here are a few important steps you can take to assess how loyalty can help you reduce churn:

Annex Cloud can help you turn churn into lasting customer loyalty

Annex Cloud is the market leader in loyalty solutions. We’re loyalty technology specialists, our solution is recognized by leading analysts and we’re continually driving innovation to deliver new value. Globally we support multiple currencies and languages. Our largest implementation is Phillip Morris which is spread across 56 different countries.

Annex Cloud’s Loyalty Experience Platform is purpose-built, enabling you to deliver a meaningful, data-led value exchange:

What makes Annex Cloud different?

-

SaaS-based platform is easy to configure and gives you instant access to the latest features and functionality with no development or re-coding required

-

Our proven success process has built effective loyalty programs for a wide range of industries

-

125+ pre-built integrations and massive partner network makes it fast and easy to go to market, and enable a truly omnichannel experience

-

Ability to collect an unlimited number of customer attributes and action on any combination to personalize experiences

-

Widest range of engagement modules to add value across the customer journey, power personalization and build trust

-

Omnichannel promo engine to allow members to earn and redeem rewards wherever they prefer to shop

-

Multi-template functionality to simplify the creation and customization of loyalty programs across regions and brands

-

Maximum flexibility to mix and match program types and reward types to fit your various customer segments and optimize for changing preferences

-

Collect and leverage zero- and first-party data and push it across your entire tech stack to elevate every interaction

To learn how loyalty can reduce your churn rate and drive lasting growth, talk to one of our experts.